maine tax rates compared to other states

With that being said the low cost of living may be less relevant depending on how much money you have for your retirement. The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015.

Which States Are Givers And Which Are Takers The Atlantic

Maine generally imposes an income tax on all individuals that have Maine-source income.

. Each states tax code is a multifaceted system with many moving parts and Maine is no exception. Hawaii and Maine Hawaii Top tax rate. No state sales tax.

52 rows Other states have a top tax rate but not all states have the same. Are Federal Taxes Deductible. No state sales tax.

Most state governments in the United States collect a state income tax on all income earned within the state which is different from and must be filed separately from the federal income tax. Although the good news is that Maine does not tax Social Security Income. They also have higher than average property tax rates.

Based on this chart New Hampshire taxpayers pay 97 of their total income to. The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that. How does Maine rank.

Income Tax Rank Effective Sales Excise Tax Rate. Your 2021 Tax Bracket to See Whats Been Adjusted. The first step towards understanding Maines tax code is knowing the basics.

When You Meet The Love Of Your Life Lyrics. The income tax rates in maine range from 58 to 715. 8 tie New Hampshire.

Use this tool to compare the state income taxes in Florida and Maine or any other pair of states. How high are sales taxes in Maine. One tax collection area where New Hampshire outpaces its neighbor.

Seniors also benefit from a number of major sales tax exemptions. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. Vehicle Property Tax Rank Effective Income Tax Rate.

One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can be as high as 715. 8 tie Puerto Rico. According to the Tax Foundation the five states with the highest top marginal individual income tax rates are.

Select State AK-Alaska AL-Alabama AR-Arkansas AZ-Arizona CA-California CO-Colorado CT-Connecticut DE-Delaware FL-Florida GA-Georgia HI-Hawaii ID-Idaho IL-Illinois IN-Indiana KS-Kansas KY-Kentucky LA-Louisiana ME-Maine MD-Maryland MA-Massachusetts MI-Michigan MN-Minnesota MS. Real-Estate Tax Rank Effective Vehicle Property Tax Rate. Discover Helpful Information and Resources on Taxes From AARP.

Effective Real-Estate Tax Rate. Ad Compare Your 2022 Tax Bracket vs. Household annual state local taxes on median us.

Restaurants In Wildwood Nj Open Year Round. This tool compares the tax brackets for single individuals in each state. Maine Tax Rates Compared To Other States.

For more information about the income tax in these states visit the Florida and Maine income tax pages. Table 2 compares state and local tax revenue by source and shows that while one form of taxation is high in a given state that same state might collect less money through other means of taxation. Sales Excise Tax Rank Effective Total State Local Tax Rates on Median US.

To determine the residents with the biggest tax burdens WalletHub compared the 50 states across the three tax types of state tax burdens property taxes individual income taxes and sales and excise taxes as a share of total personal income in the state. 531 2 2. 548 1 251 21 343 24 4.

The five states with the lowest top marginal individual income tax rates are. Franchise Tax Bd Cast Tax. Therefore 55 is the highest possible rate you can pay in the entire state of Maine.

Maine Tax Rates Compared To Other States. These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021. Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory.

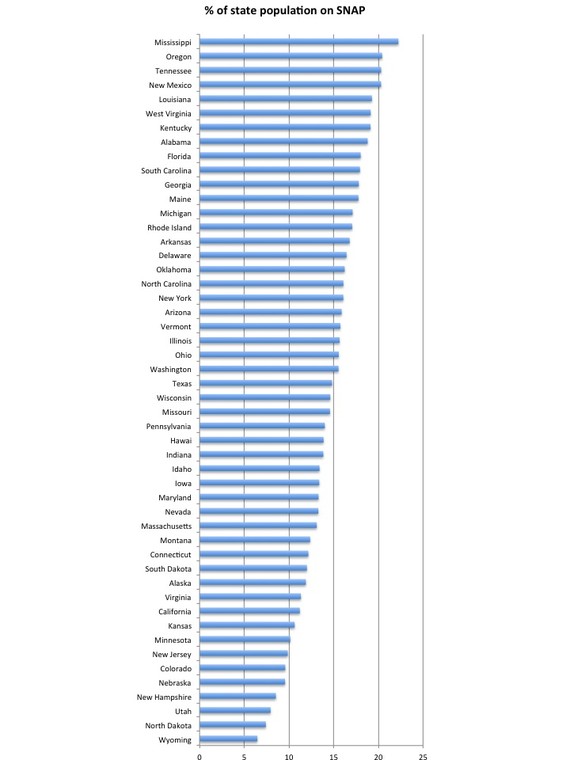

Social security is not taxed but pensions and retirement plans are both partially taxed. For income taxes in all fifty states see the income tax by state. Maines percentage was 105 slightly more than the portion in.

Maine State Single Filer Personal Income Tax Rates and Thresholds in 2022. The taxes were ranked as a percentage of total personal income in each state. Below we have highlighted a number of tax rates ranks and measures detailing Maines income tax business tax sales tax and property tax systems.

State Alcohol Excise Tax Rates Tax Policy Center

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

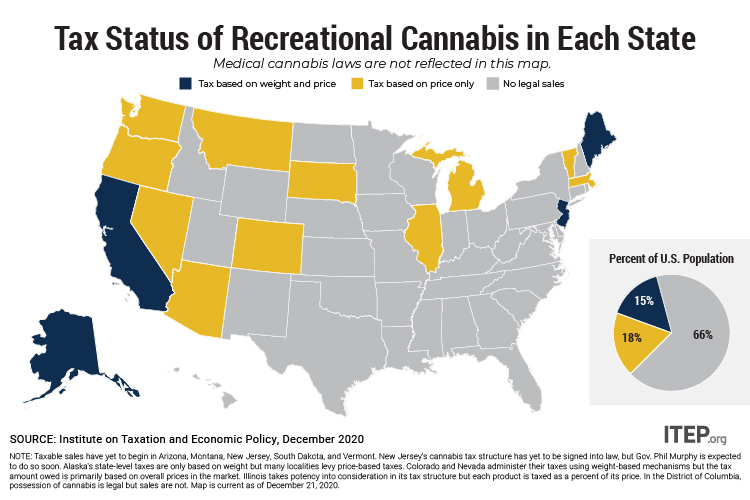

New Jersey Leads By Example With Its New Cannabis Tax Itep

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

Sales Tax By State Is Saas Taxable Taxjar

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

State Corporate Income Tax Rates And Brackets Tax Foundation

Maine Plant And Animal Life Britannica

Maine Income Tax Calculator Smartasset

Tax Maps And Valuation Listings Maine Revenue Services

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy

State Corporate Income Tax Rates And Brackets Tax Foundation

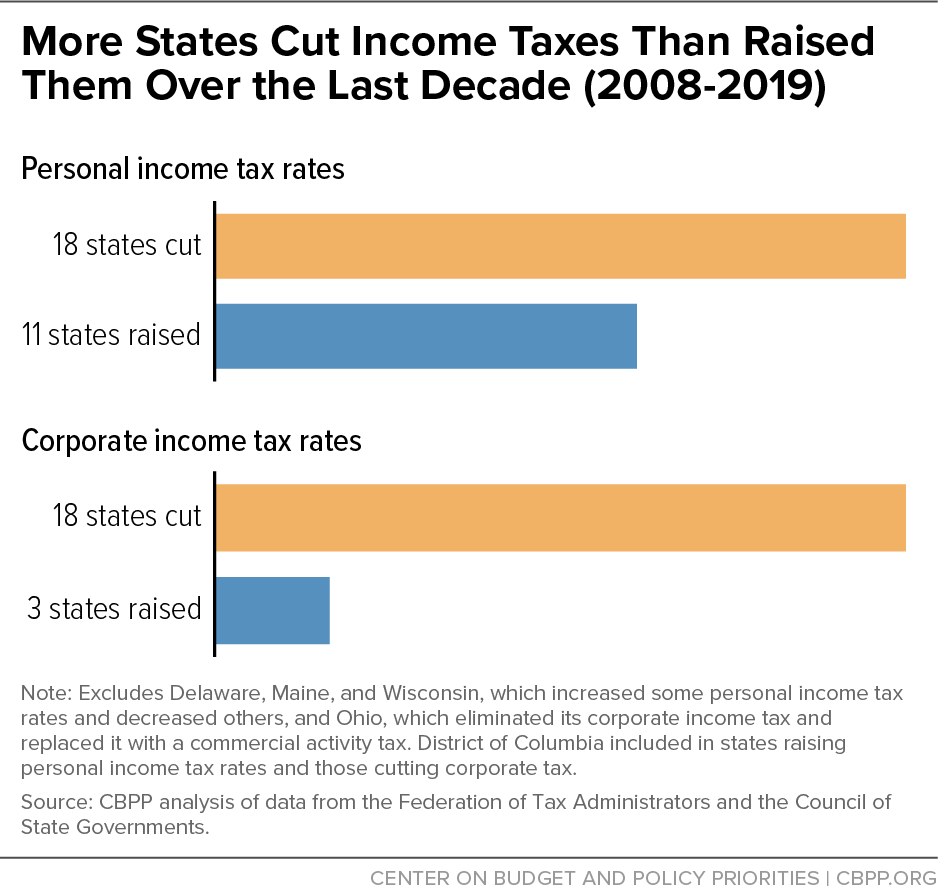

States Can Learn From Great Recession Adopt Forward Looking Antiracist Policies Center On Budget And Policy Priorities

Vape E Cig Tax By State For 2022 Current Rates In Your State

State Corporate Income Tax Rates And Brackets Tax Foundation