tax benefit rule examples

The tax benefit rule is codified in 26 USC. However in 2012 the taxpayer receives a state tax refund.

Section 80d Deductions For Medical Health Insurance For Fy 2021 22

Common examples of tax shelters include municipal bonds and employer-sponsored 401 k plans.

. If the QOF investment is held for 5 years. When the state return is filed the taxpayer has an overpayment of 2000. The building is a total loss.

Related Courses Small Business Tax Guide. The tax benefit rule ensures that if a taxpayer takes a deduction attributable to a specific event and the amount is recovered in a subsequent year income tax consequences of the later event depend in some degree on the prior related tax treatment. But instead of paying the investor reinvests the 1 million gain in a QOF.

How Does a Tax Benefit Work. The tax benefit rule has been developed by court decisions statutes and revenue rulings2 Basically the. See Cents-Per-Mile Rule in section 3.

Tax Advantages For Donor Advised Funds Nptrust. Suffers a fire a few days after completion of a building that cost 500000 to build. As a result the tax advisor needs to.

7 The tax benefit rule applies not only to recoveries in a strict sense but also to situations involving increments to net worth. This represents the total amount of state income tax withheld from your wages in 2012 from your Form W-2. The meaning of TAX BENEFIT RULE is a tax rule requiring that if an amount as of a loss used as a deduction in a prior taxable year is recovered in a later year it must be included in the gross income for the later year to the extent of the original deduction.

Lets say everything is the same as the last example except your total itemized deductions total 20000. A taxpayer used a standard deduction in 2011. Tax benefit rule definition and examples.

A taxpayer itemized in 2011 and deducted state income taxes paid in 2011. Of the 1000 refund you receive from Iowa 400 of it will be taxable on your 2017 federal return. When deferment ends only 90 percent or 214200 is owed saving 23800 in capital gains taxes.

This common example has many variations. TAX BENEFIT RULE But the tax benefit rule has also found application in noncorporate taxation areas outside those explicitly mentioned by section 111 and has spawned related concepts along the way both through court decisions and statutes. No Tax Knowledge Needed.

For example - you deducted 1000 in state income taxes on your 2012 Schedule A. If a taxpayer for example claimed as a business expense bad debts are written off amounting to 3000 in 2019 and in 2020 managed to recover 2000 of the amount written off the 2000 must be. Examples of tax benefit.

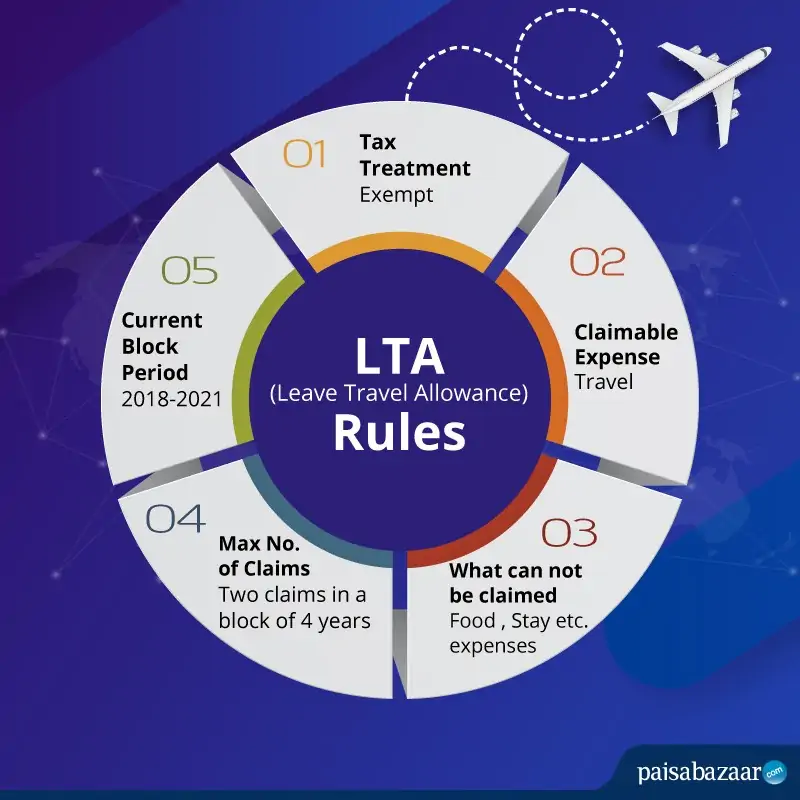

The Dobson case is a prime example of the conflict which had developed at that time between the Board of Tax Appeals now known as the Tax Court and the federal courts as to whether the tax benefit rule should be applied. State income tax refund fully includable. On Schedule A they listed real estate taxes of 7000 and state income taxes of 7000.

For example consider a taxpayer who pays no state income taxes in year 1 and takes no deduction in year 1 but pays 5000 with the state extension in April of year 2. Example of the Tax Benefit Rule Mr. For example lets assume that in 2009 Company XYZ expected to receive 100000 from a.

Its also the name of an IRS rule requiring companies to pay taxes on income that was previously written off but is subsequently recovered. The following examples provide an illustration of the mechanics of the tax benefit rule and how it should work with respect to the new law and the 10000 annual limitation. Acme writes off the 500000 loss as an expense on.

For instance to qualify for head of household. 9 The rule also applied when a tax-. The 238000 capital gains tax is completely deferred plus the investor gets a 10 percent step-up in basis on the original gain.

A couple paid 4000 in state taxes in the prior year and claimed itemized deductions totaling 14000. Answer Simple Questions About Your Life And We Do The Rest. Taxable Income What Is Taxable Income Tax Foundation.

If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income. Gross income does not include income attributable to the. The rule is promulgated by the Internal Revenue Service.

A tax benefit is any tax advantage given by the IRS to a taxpayer that reduces his or her tax burden. When the couple paid the excess refund 400 to the state in the prior year it increased their itemized deduction on their federal return. The 1000 must be included in his current years reported gross income.

You may use this rate to reimburse an employee for business use of a personal vehicle and under certain conditions you may use the rate under the cents-per-mile rule to value the personal use of a vehicle you provide to an employee. 8 For example the tax bene- fit rule applied when a seller reimbursed a buyer for interest that the buyer had prepaid and previously deducted. A tax benefit also includes.

You must be eligible for tax benefits to claim them. Had A paid only the proper amount of state income tax in 2018 As state and local tax deduction would have been reduced. A tax benefit in the prior taxable year from that itemized deduction.

According to the tax benefit rule - part of the state income tax refund above standard deduction is included into 2012 taxable income. Type Of Direct Tax Compliances In India Examples Meaning Ascgroup Transfer Pricing Taxact Compliance. Jones recovers a 1000 loss that he had written off in his previous years tax return.

Thursday March 17 2022. The business mileage rate for 2021 is 56 cents per mile. Taxpayer makes payments of year 1 taxes in year 2.

For example if a taxpayer recovers an expense or loss that he previously wrote off against the prior years income then the recovered amount must be included in the current years gross income. In 2019 A received a 1500 refund of state income taxes paid in 2018. File With Confidence Today.

Joe and Denise Smith itemize deductions on their 2018 income tax return. A tax benefit is interpreted broadly and includes any exclusion deduction or credit which reduced federal income tax due in a prior year. Acmes insurance company refuses to pay the claim suspecting arson.

Ad TurboTax Makes It Easy To Get Your Taxes Done Right.

What Is A Homestead Exemption And How Does It Work Lendingtree

Income Profession Tax Benefits For Disabled Handicapped Persons

Annuity Taxation How Various Annuities Are Taxed

How The Tcja Tax Law Affects Your Personal Finances

What Are Itemized Deductions And Who Claims Them Tax Policy Center

New Income Tax Slabs Will You Gain By Switching To New Regime The Economic Times

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

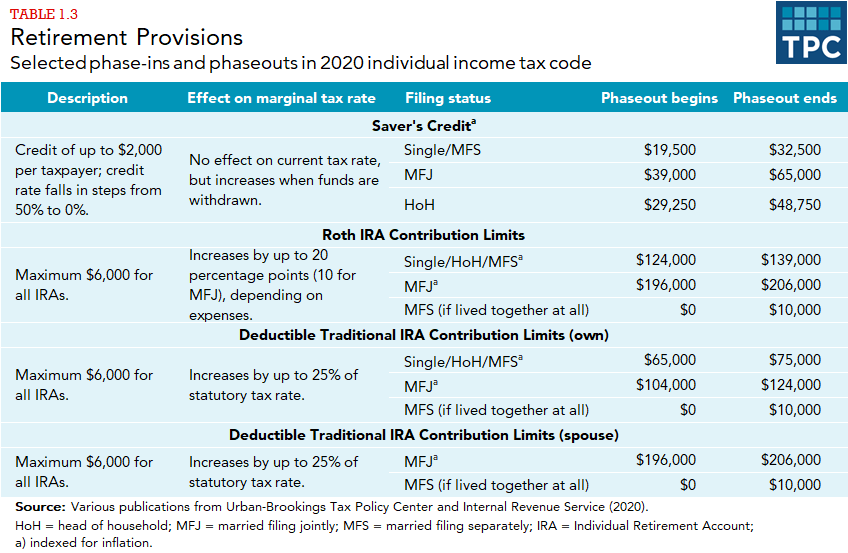

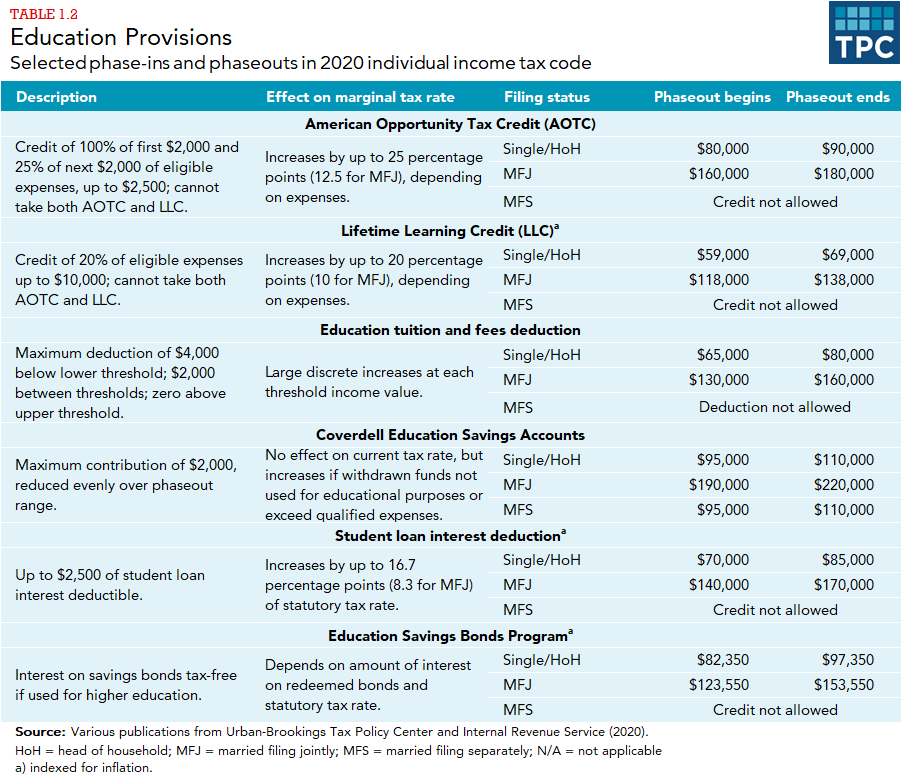

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

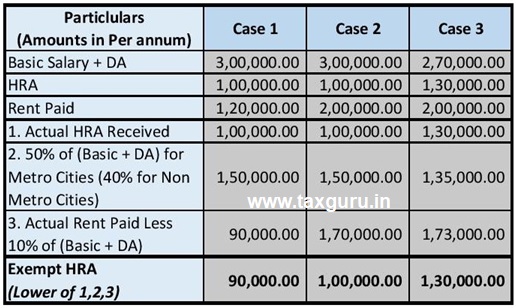

Leave Travel Allowance Lta Claim Rule Eligibility Tax Exemptions

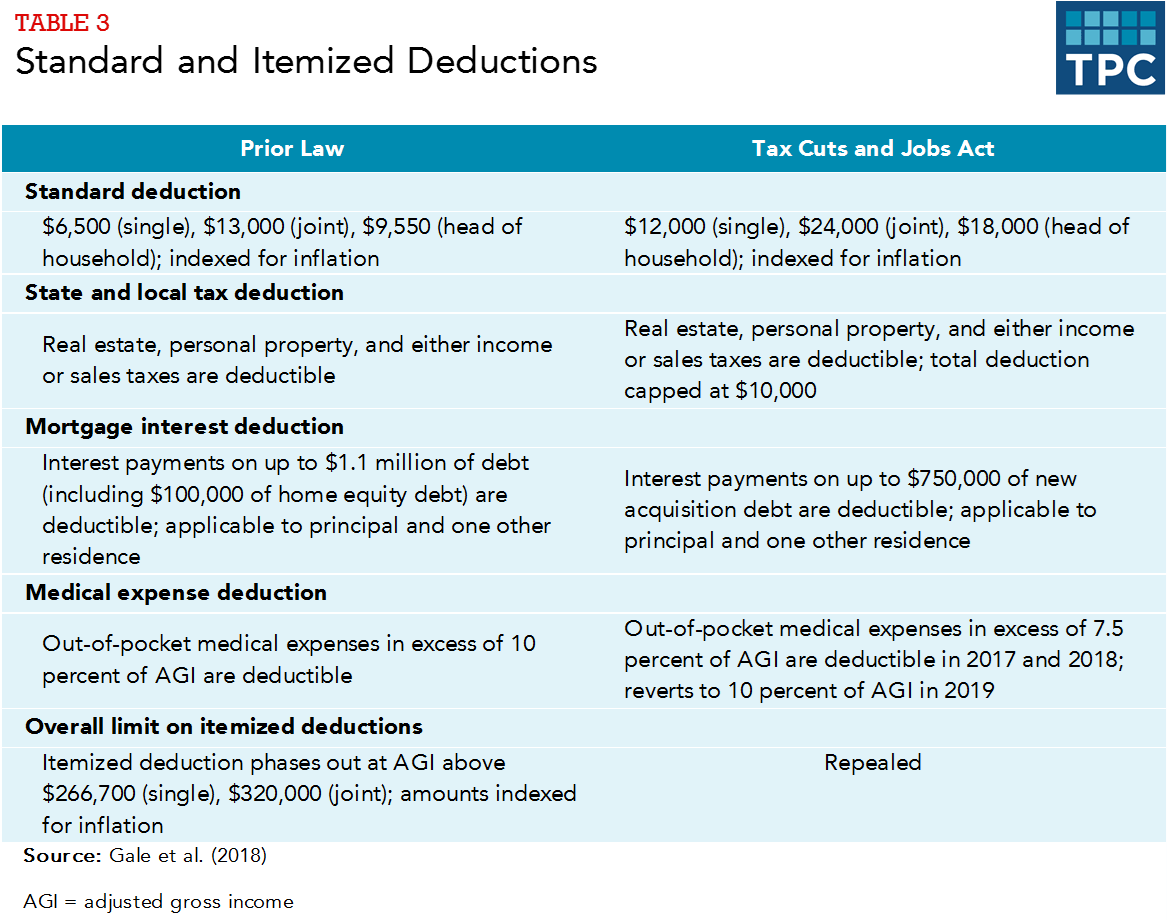

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Tax Shield Formula How To Calculate Tax Shield With Example

Section 80ddb Diseases Covered Certificate Deductions Tax2win

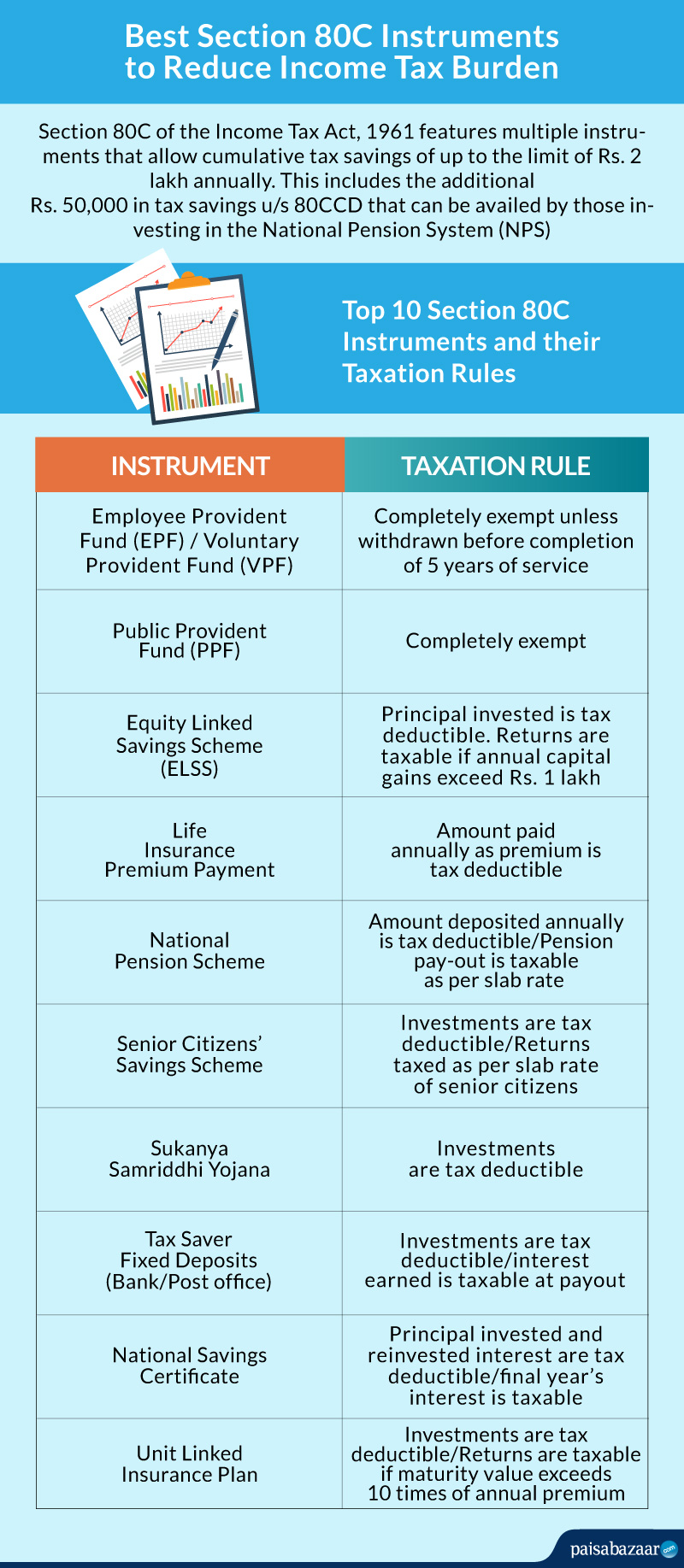

Section 80c Deduction Under Section 80c In India Paisabazaar Com

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center