internet tax freedom act texas

Internet Tax Freedom Act ITFA The ITFA was enacted in 1998 as a 3-year moratorium preventing governments at the local state and federal levels from imposing. 3086 is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on.

U S Appeals Court Rejects Big Tech S Right Regulate Online Speech Reuters

Texas collected tax on.

. 3086 the Permanent Internet Tax Freedom Act. The new act the Internet Tax Freedom Act Amendments Act of 2007 included a new definition of internet access which means a service that enables users to connect to the Internet to. On June 17 the House Judiciary Committee approved HR.

The Internet Tax Freedom Act of 1998 ITFA. Internet Tax Freedom Act - Title I. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1.

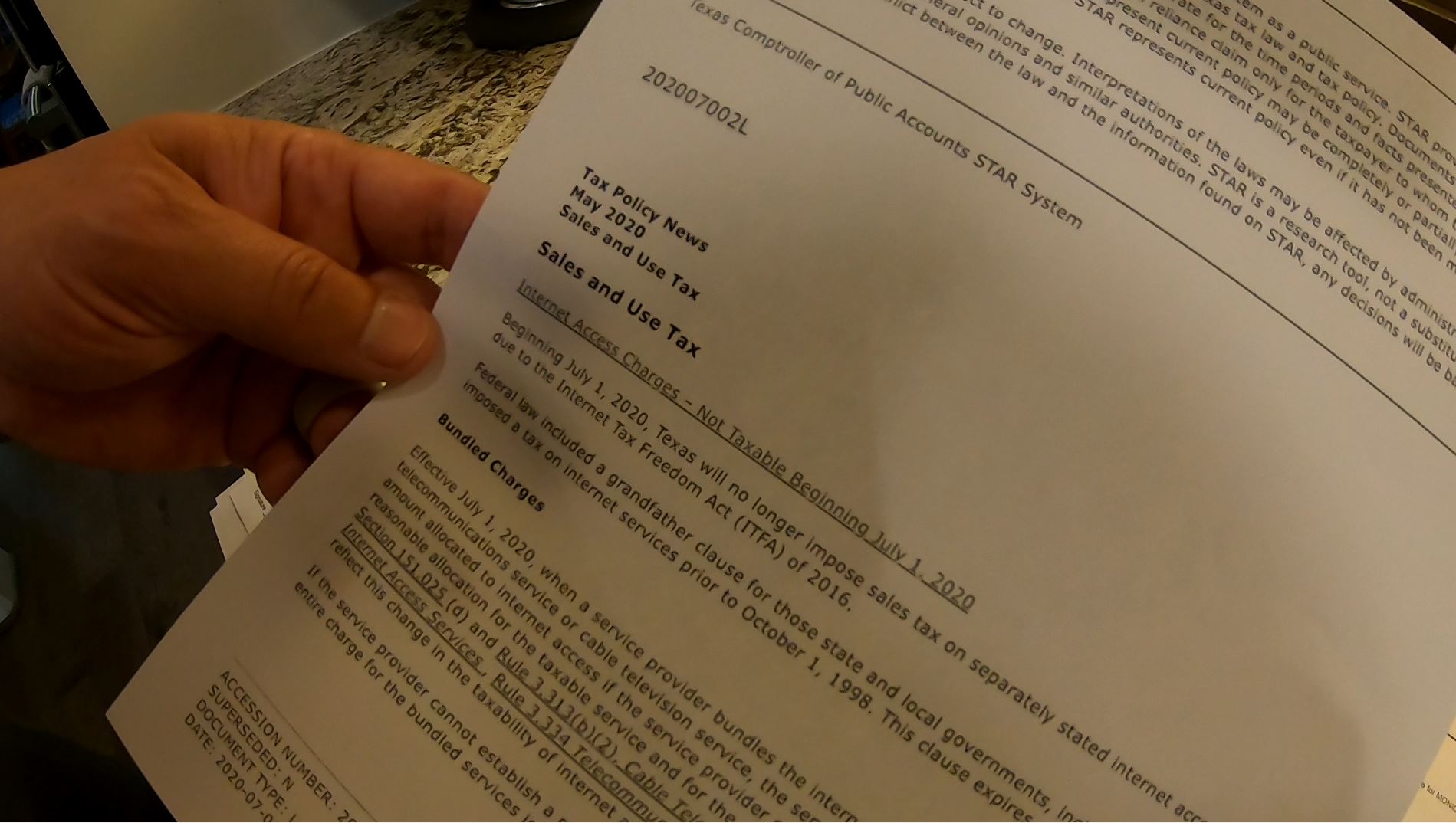

The Internet Tax Freedom Act ITFA was enacted in 1998 to delay any special taxation of. 105-277 which enacted in 1998 implemented a three-year moratorium preventing state and local governments. Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin.

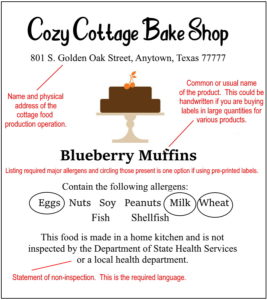

105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1. Solve Tax for Good with end-to-end sales and use tax software. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet.

The bill could be brought to the floor as early as July 14. Ad Manage the sales use tax process from calculating tax to managing exemptions filing. This report discusses the Internet Tax Freedom Act ITFA.

Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet. The Internet Tax Freedom Act of 1998 ITFA. As of July 1 2020.

The Permanent Internet Tax Freedom Act is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on state and local taxation of Internet access and on multiple. By Chanel Christoff Davis in Sales Tax State Sales Tax Laws Texas. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the.

Federal law included a grandfather. The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would. Texas does not impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016 effective July 1 2020.

Passed the House on July 15 2014 voice vote The Permanent Internet Tax Freedom Act HR. Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month. Little-noticed changes to the Internet Tax Freedom Act made by Congress in 2007 expanding the scope of services preempted from state taxation are at issue in Apple Inc.

How Texas Spends Its Money How Texas Gets Its Money Why It Doesn T Add Up

Currents Journal Of International Economic Law South Texas College Of Law Houston

The Fbi Calls It An Extremist Militia What Exactly Is This Is Texas Freedom Force Tpr

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Us Salt Alert Il Amends Click Through Nexus Statutes To Address Inte

Kprc 2 Investigates Internet Customers Wrongly Charged For Years Now Getting Refund

Amazon Com Texas Roadhouse Gift Card 25 Gift Cards

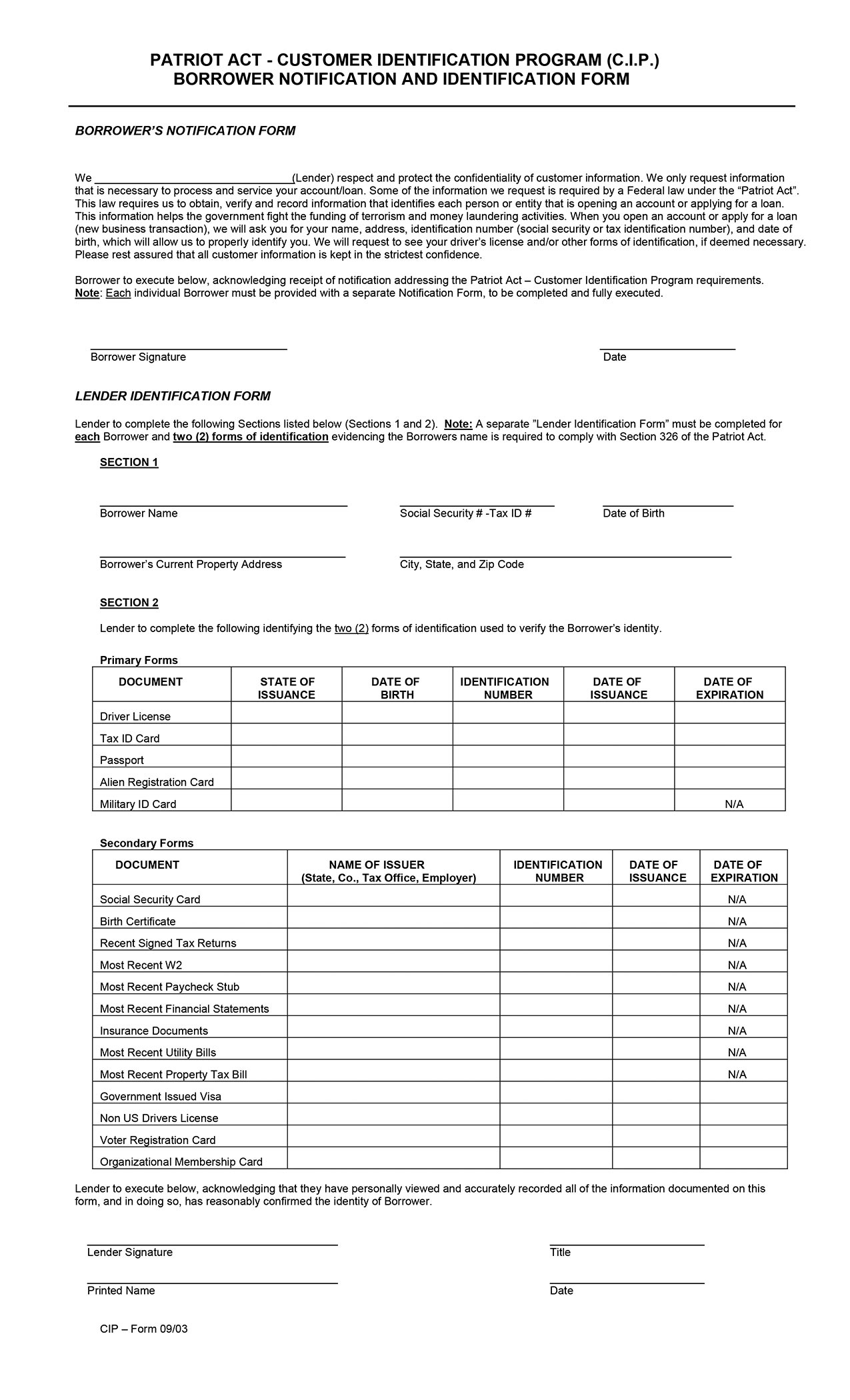

Notary Signing Agent Document Faq Usa Patriot Act Cip Forms Nna

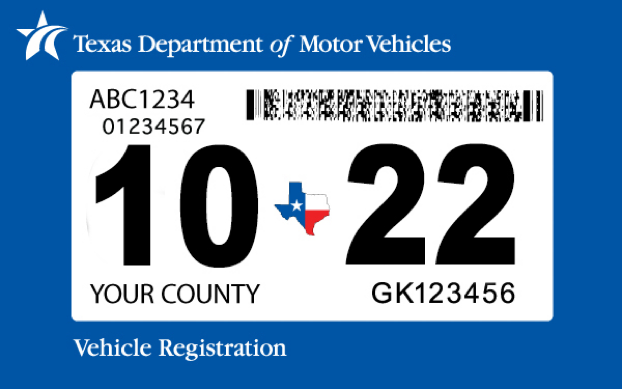

Tax Assessor Collector Fort Bend County

.png)

Austin Is My Home Austintexas Gov

Sales Tax Laws By State Ultimate Guide For Business Owners

Texas Schools Are Surveilling Students Online Often Without Their Knowledge Or Consent

Texas Sales Tax Small Business Guide Truic

San Jose Seller S Permits Ca Business License Filing Quick And Easy

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

States With Minimal Or No Sales Taxes

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

Google Must Face Most Of Texas Lawsuit Over Ad Dominance Judge Rules Reuters